cap and trade vs carbon tax upsc

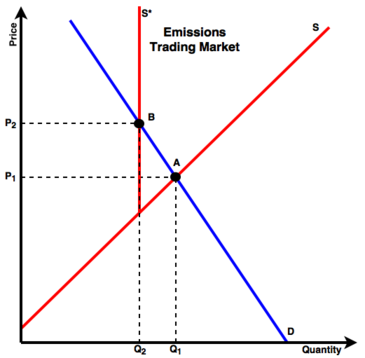

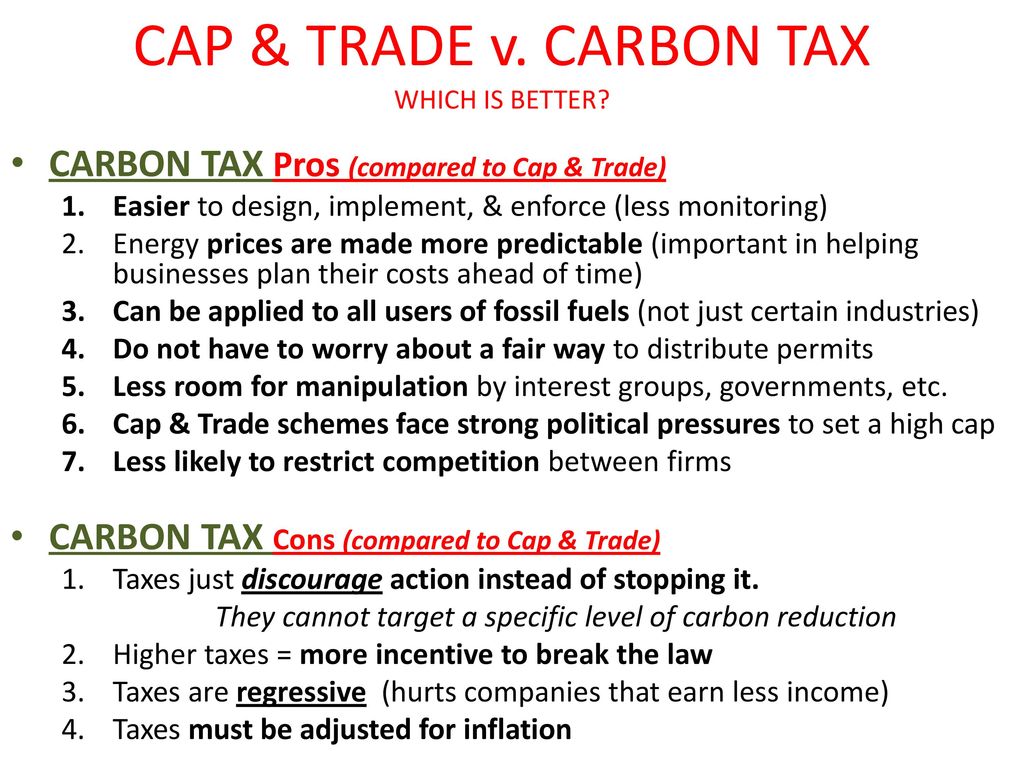

There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some. Emissions trading or cap-and-trade CAT and a carbon tax are fundamentally different tools to limit the effects of using fossil fuels.

Upsc Dna 24th Jan 2015 Gs Today

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas.

. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism. Cap-and-Tradethe approach most popular among politicianswould put a quantitative limit on annual carbon emissions by auctioning permits that power plants and. A carbon tax and cap-and-trade are opposite sides of the same coin.

I find it really hard to believe but the perennial carbon tax vs. It goes on and on and on and it never changes. Cap-and-trade debate is still going on.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. A carbon tax is one way to put a price on emissions. However in reality they differ in.

In contrast cap and trade levies an implicit tax on carbon. Cap and Trade have one environmental advantage over Carbon tax as it provides more certainty about the number of emission reductions that will lead to a little less certainty. A carbon tax and cap-and-trade system complement each other ensuring there is a price on CO2 emissions across the entire economy given that a cap-and-trade system typically covers large.

Carbon trading allows countries and companies to. Carbon taxes makes emitting carbon dioxide more. A carbon tax sets the price.

On the other hand political economy forces strongly point to less. It provides more certainty about the amount of emissions reductions that will result and little certainty about the price. In certain idealized circumstances carbon taxes and cap-and-trade have exactly the same outcomes since they are both ways to price carbon.

This can be implemented either through. Each approach has its vocal supporters. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions.

April 9 2007 413 pm ET. With a carbon tax there is an immediate cost to. Carbon trading allows countries and companies to sell their carbon credits for money.

With a tax you get certainty about prices but uncertainty about emission reductions. Under the prevailing Kyoto Protocol climate agreement carbon credits are used in market-based system of Carbon Trading. Cap-and-trade has one key environmental advantage over a carbon tax.

With a cap you get the inverse. Those in favor of cap and trade. A carbon tax is an explicit tax and Americans are notoriously tax phobic.

You can do the same to cap-and-trade. You can tweak a tax to shift the balance. Carbon Tax vs.

Pricing Carbon A Carbon Tax Or Cap And Trade

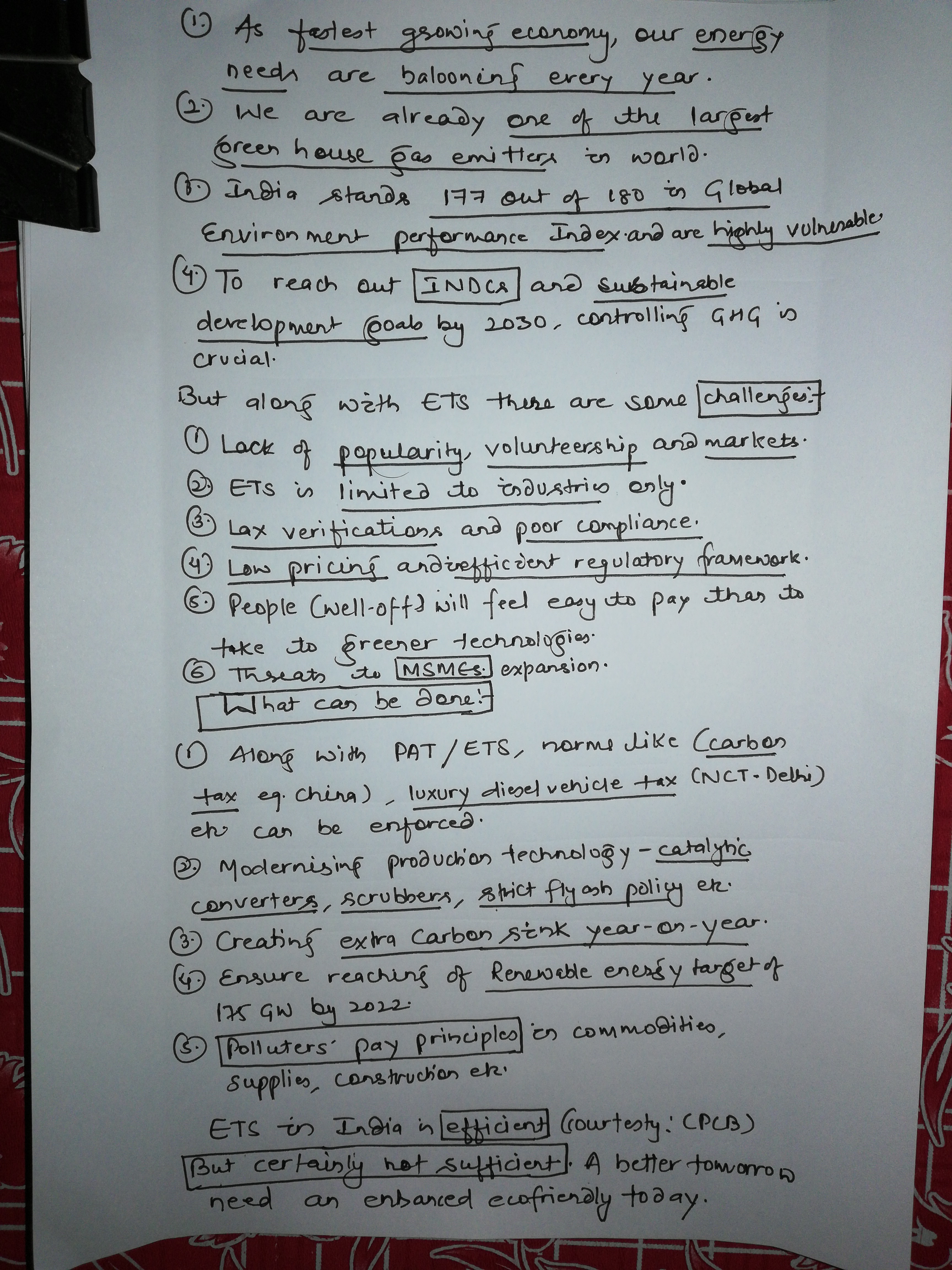

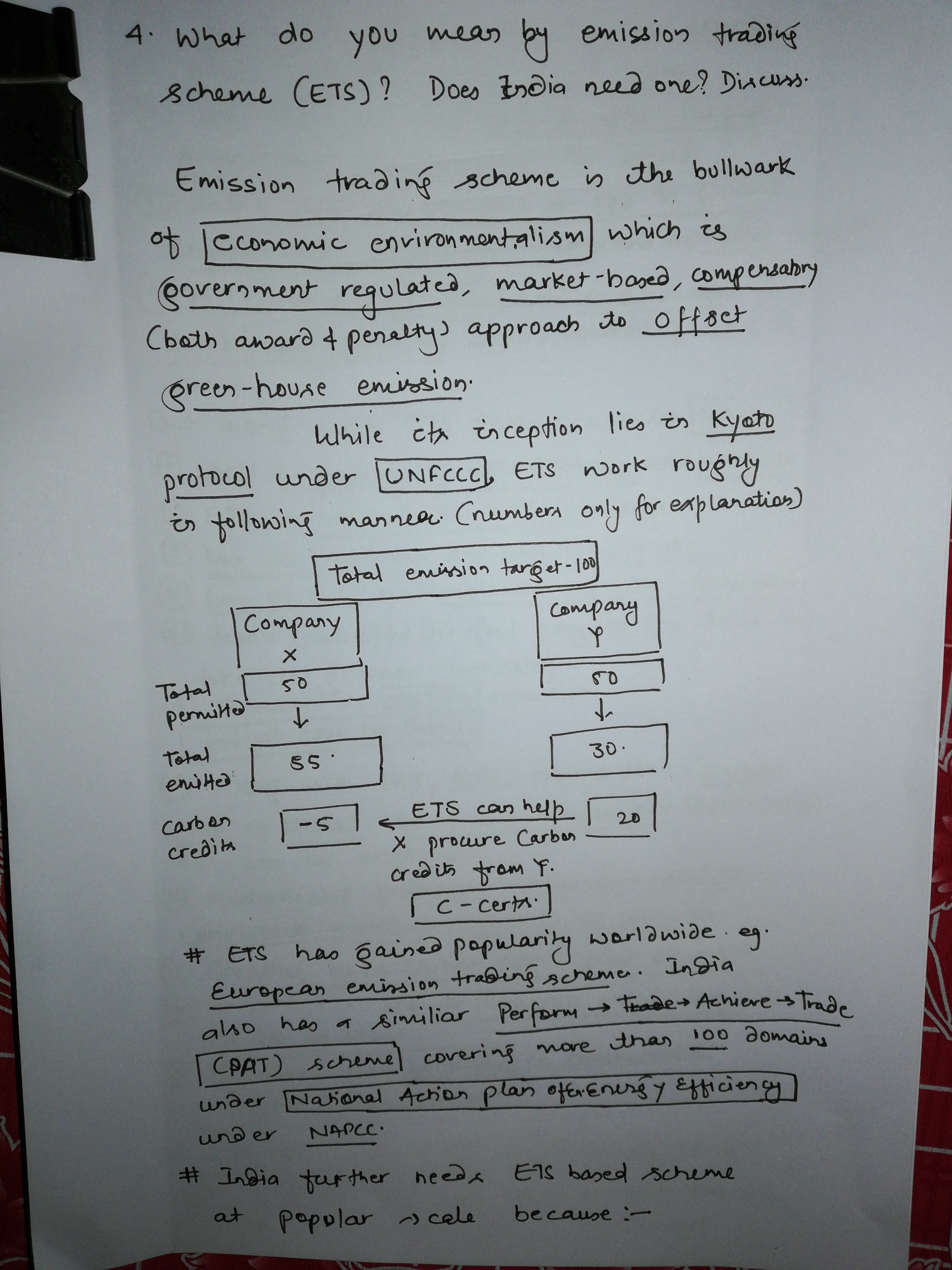

Tlp Iasbaba Day 13 Q 4 What Do You Mean By Emission Trading Scheme Ets Does India Need One Discuss

Pdf Carbon Tax Vs Cap And Trade Implications On Developing Countries Emissions Semantic Scholar

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal India S Largest Community For Upsc Exam Aspirants

Insights Into Editorial A Case For A Differential Global Carbon Tax Insightsias

Tlp Iasbaba Day 13 Q 4 What Do You Mean By Emission Trading Scheme Ets Does India Need One Discuss

Green Supply Chain News Summarizing Cap And Trade Versus Carbon Taxes To Deal With Co2

Carbon Pricing Types Pros And Cons Of Carbon Tax For Upsc Exam

Carbon Tax Vs Emissions Trading Energy Education

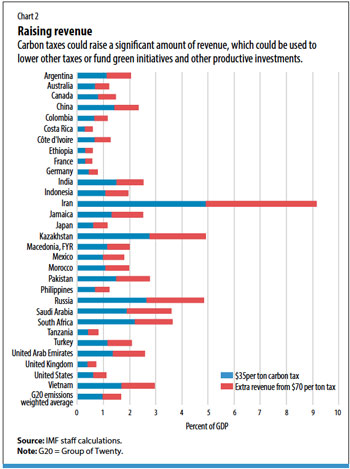

The Case For Carbon Taxation Imf F D December 2019

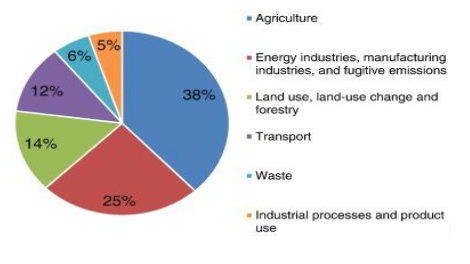

Greenhouse Gas Emissions Wikipedia

Unfccc Kyoto Protocol Unfccc Summit 1997 Carbon Trading Pmf Ias

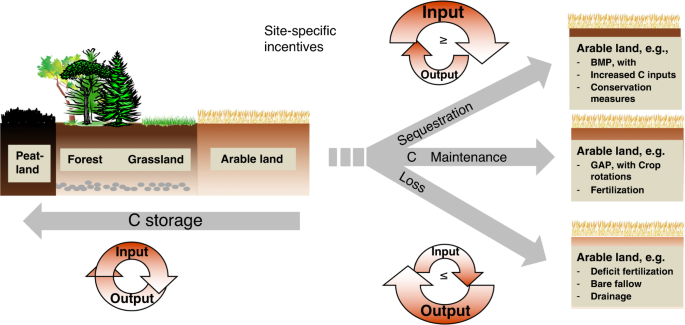

Towards A Global Scale Soil Climate Mitigation Strategy Nature Communications

Market Failure Externalities And Beyond Ppt Download

A Clean Innovation Comparison Between Carbon Tax And Cap And Trade System Sciencedirect

Upsc Prelims 2019 Answer Key Analysis Drishti Ias

Efficient Pricing Of Carbon In The Eu And Its Effect On Consumers Journalquest